5. Don’t expect many people to have deep understanding

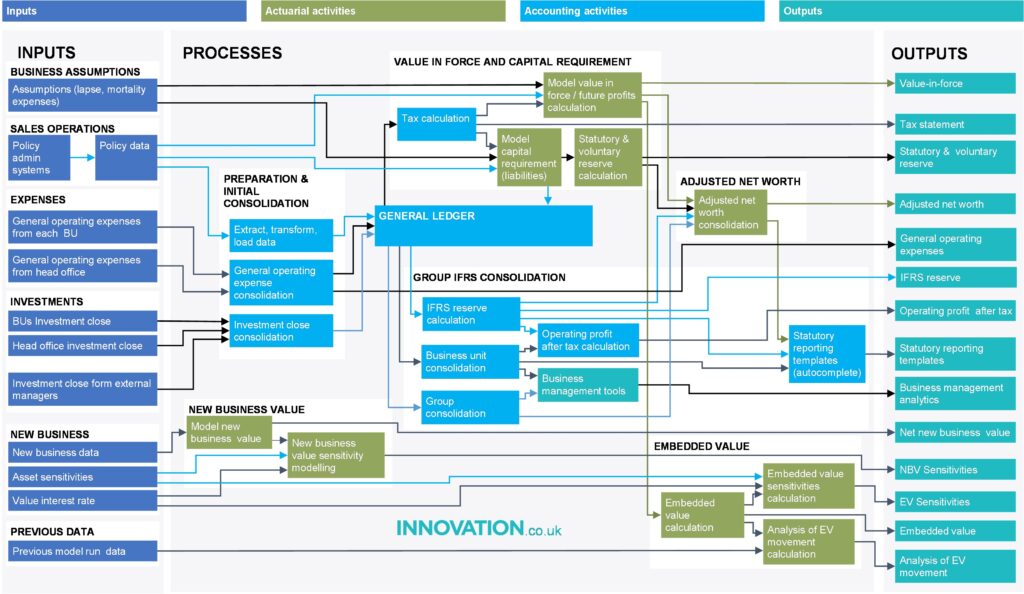

Insurance companies are large and complex with vertical lines of integration. This means that stakeholders really get to see ‘the whole picture’. Vertical integration also means that a system integration in one country rarely translates to other jurisdictions.

Clients won’t always know about the touch points that any tech implementation has. Front office teams will focus on relatively short-term initiatives, whereas tech change has a long-term impact with slowly realised, but vast benefits.

Bringing front and back-office teams together rarely happens, even more rare is a logical layout of how the whole business works (such as the insurance close operating model we share here – virtually every insurance company will operate like this, but virtually none have it recorded).

- Business people won’t understand what tech people articulate

- Insurer’s digital people already have to be evangelists – traditional talent strategies haven’t encouraged these folks to join insurers

- Insurance policies are often around for a very long time, so the processes, systems and data might have cobwebs on them

- Insurers operate differently from country to country – most countries are highly autonomous

- What you think you need to deliver may not be reality: The client’s “as-is” & “to-be” states are rarely mapped

- Product and service performance issues not necessarily analysed

One of the reasons subject-matter experts generally do not make good project managers is that they are so focussed on their area of expertise. For a project to be truly successful, it needs to be managed by experts in delivering across the whole organization and empowering experts in particular knowledge areas. This is discussed in the next section.

- Get the requirements clear

- Complexity is a reality, manage it well

- Realistic & collaborative planning

- Get everyone comfortable with realistic timelines

- Don’t expect many people to have deep understanding

- Good project management saves time and money

- Good two-way communication and governance

- Understanding your impact on the client

- Don’t shortcut testing

- MVP vs Quality