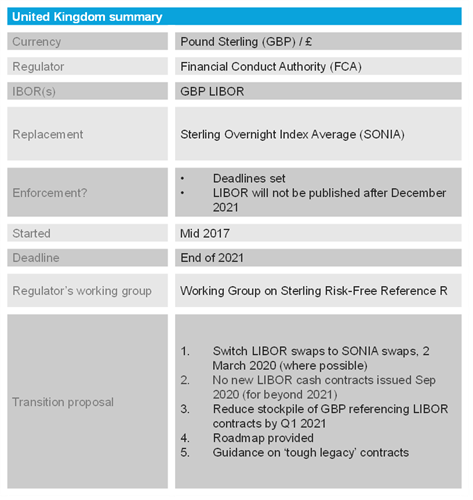

IBOR - Impact on UK (Pound Sterling)

The FCA confirmed in mid-2017 that the GBP LIBOR would be phased out in the UK by the end of 2021 to be replaced by SONIA, which will be administered by the Bank of England.

The rate is to be calculated as the weighted average of the interest rates charged for all unsecured loans reported by market participants in the London overnight market.

SONIA is based on overnight interest rates in wholesale markets, so is close to a risk-free measure of borrowing costs. The rate is anchored to an active and liquid underlying market and can be compounded over a lending period to produce a term interest rate.

By February 2020, the Working Group on Sterling Risk-Free Reference Rates had set out several milestones it expected market participants affected by the transition to reach over the following year. This included the switching of LIBOR swaps to SONIA swaps, where possible, by 2 March 2020. Cessation of issuance of GBP LIBOR-based cash products beyond 2021 by the end of Q3 2020; and the significant reduction of the stock of GBP LIBOR referencing contracts by Q1 2021.

More generally, the committee provided a roadmap that market participants should take to reduce their LIBOR exposure, including taking steps to enable a further shift of volumes from LIBOR to SONIA in derivatives markets and giving consideration as to how best to address issues regarding “tough legacy” contracts.

Above all, the committee encouraged all market participants who rely on LIBOR to “read, reflect and act on these communications” to ensure they take all reasonable steps to ensure the end of LIBOR does not lead to market disruption or harm to consumers, and to support industry initiatives to ensure a smooth transition.

Click on the topics below:

IBOR home

Background

Major currencies

- Detailed list of known IBORs and their changes

- Impact on Hong Kong (Hong Kong Dollar)

- Impact on Singapore (Singapore Dollar)

- Impact on UK (Pound Sterling)

Delivering change

Contract changes