IBOR - Current IBORs

Global markets have been reliant on IBORs for nearly four decades, prevailing market view is that this is neither desirable, nor sustainable.

Action is required to transition from IBORs to alternative risk-free rates. This is particularly important for markets with high IBORs in low income economies to avoid exploitation. Countries like Argentina with an Interbank rate of 30,07% and Angola with 19,87% in March 2020 are examples of high-risk rates in poorer economies.

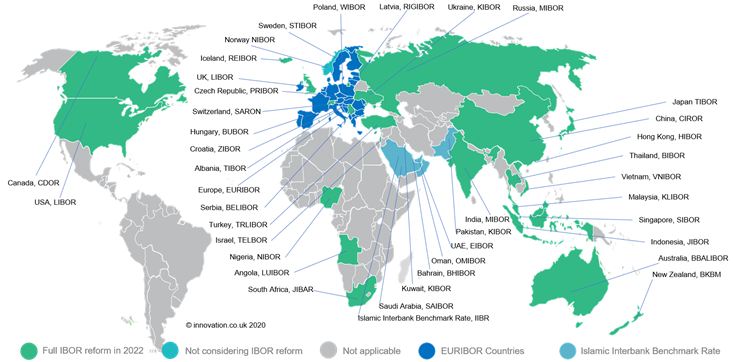

Markets around the world have taken steps to transition from their existing rates. Several jurisdictions have recommended risk free rates (RFR) to transition to. Other IBORs globally have not yet shown any sign of awareness of the IBOR reform. Most of the markets that have shown recognition, find a broad gap between awareness and action. We have tracked about 40 IBORs globally:

Click on the topics below:

IBOR home

Background

Major currencies

- Detailed list of known IBORs and their changes

- Impact on Hong Kong (Hong Kong Dollar)

- Impact on Singapore (Singapore Dollar)

- Impact on UK (Pound Sterling)

Delivering change

Contract changes