IBOR - Impact on Singapore (Singapore Dollar)

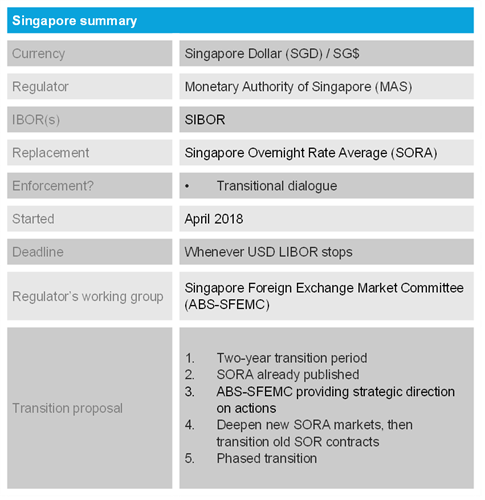

The Association of Banks in Singapore and the Singapore Foreign Exchange Market Committee (ABS-SFEMC) established a working group in November 2018 to conduct a review of the implications of LIBOR discontinuation on the Sing-dollar Swap Offer Rate (SOR).

Shortly after, the Monetary Authority of Singapore (MAS) confirmed that the city state would transition from the use of the SOR to the Singapore Overnight Rate Average (SORA) over a two-year period. This decision was made after broad consultation dismissed two further options: the reformation of SOR to abandon a US interest rate benchmark in favour of an SGD benchmark; and the enhancement of Singapore’s own interbank benchmark (SIBOR) that would have concentrated SGD derivatives markets on a single SIBOR benchmark.

The SORA is published by MAS and reflects the volume-weighted average rate of unsecured overnight interbank SGD transactions brokered in Singapore. It is considered by the MAS to be a more robust and suitable alternative to SOR as it is a transaction-based benchmark underpinned by a deep and liquid overnight funding market. Moreover, the SORA has a stronger correlation to SIBOR that SOR, a problem that had long undermined the use of SOR-based interest rate derivatives for hedging of SIBOR exposures.

As the discontinuation of USD LIBOR will impact the sustainability of SOR, financial contracts that reference SOR, such as SGD interest rate derivatives, should transition to reference SORA. SGD cash products such as loans that reference SOR can in the meantime continue to reference multiple benchmarks, including SIBOR, SORA, or banks’ internal funding rates.

The Steering Committee for SOR Transition to SORA has confirmed it will provide strategic direction to develop new products and markets based on SORA and will, more generally, offer feedback and raise awareness on issues related to the transition.

The ABS-SFEMC has recommended a phased approach for the transition to those industries affected that should take into account the need to deepen new SORA-based markets before transitioning legacy SOR-based contracts to reference SORA. Above all, authorised institutions must remain up-to-date on relevant developments regarding the transition at both a local and international level and formulate a roadmap to transition as soon as possible.

Click on the topics below:

IBOR home

Background

Major currencies

- Detailed list of known IBORs and their changes

- Impact on Hong Kong (Hong Kong Dollar)

- Impact on Singapore (Singapore Dollar)

- Impact on UK (Pound Sterling)

Delivering change

Contract changes