M&A is more effective when planned

INNOVATION HELPS DELIVER GREAT M&AS

We have been involved with a number of M&A projects – including acquisitions, bancassurance, buy-outs and divestments.

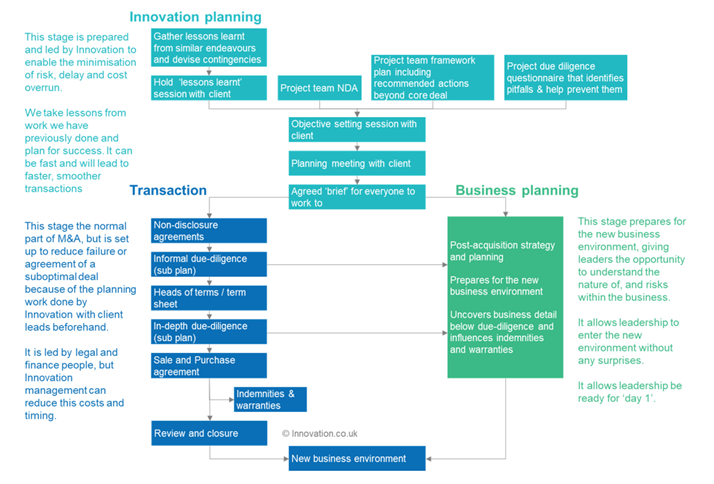

M&A is usually seen as a legal and risk planning exercise. Participants don’t always recognise that to make the outcome of a deal successful, the work needs to be supported with excellent planning and delivery. Below is our standard M&A delivery model, followed by a case study of one of our M&A.

The usual ‘deal-making’ part of the transaction is illustrated in dark blue. The Innovation planning element comes first – it looks like the this lengthens the time to do the deal, but it shortens it because a script to confront the pitfalls means that the formal transaction stage can take less time because surprises are largely eliminated.

Innovation’s M&A management model

Example of Innovation delivering a buy-out for a client

THE CHALLENGE

A UK insurance brokerage incorporating a Lloyd’s Syndicate wished to identify all of the elements for consideration in the planning and negotiation of an management buy-out (MBO) from a large international Insurance group. The group had indicated that there was limited time in which they could bid to buy the UK subsidiary.

INNOVATION SOLUTION

One of Innovation’s Programme Delivery and Information Architects was assigned to provide an in-depth analysis of all management, organisational, regulatory, staff, processes, information, systems, telecoms & facilities impacts, issues and risks. This work is illustrate in the green ‘ business planning’ box above.

The big challenges were around the access to historical data, much of which was still in physical format or within individual spreadsheet applications. By identifying the data and the information flows it was possible to assess the risks to the business and to create a risk reduction programme, which could be implemented once the MBO took place. We also identified the cost of achieving these changes and identification of additional costs associated with the change of ownership.

The comprehensive overview presentation and report enabled the incumbent directors of the company to create the MBO proposal more rapidly and to present to a funding organisation.

THE OUTCOME

Because of our speed and structure of the planning and management, the financier, an investment company, rapidly agreed to support the deal and it went through. The acquired company is now independent and successful.