Transformation of Prudential in Hong Kong

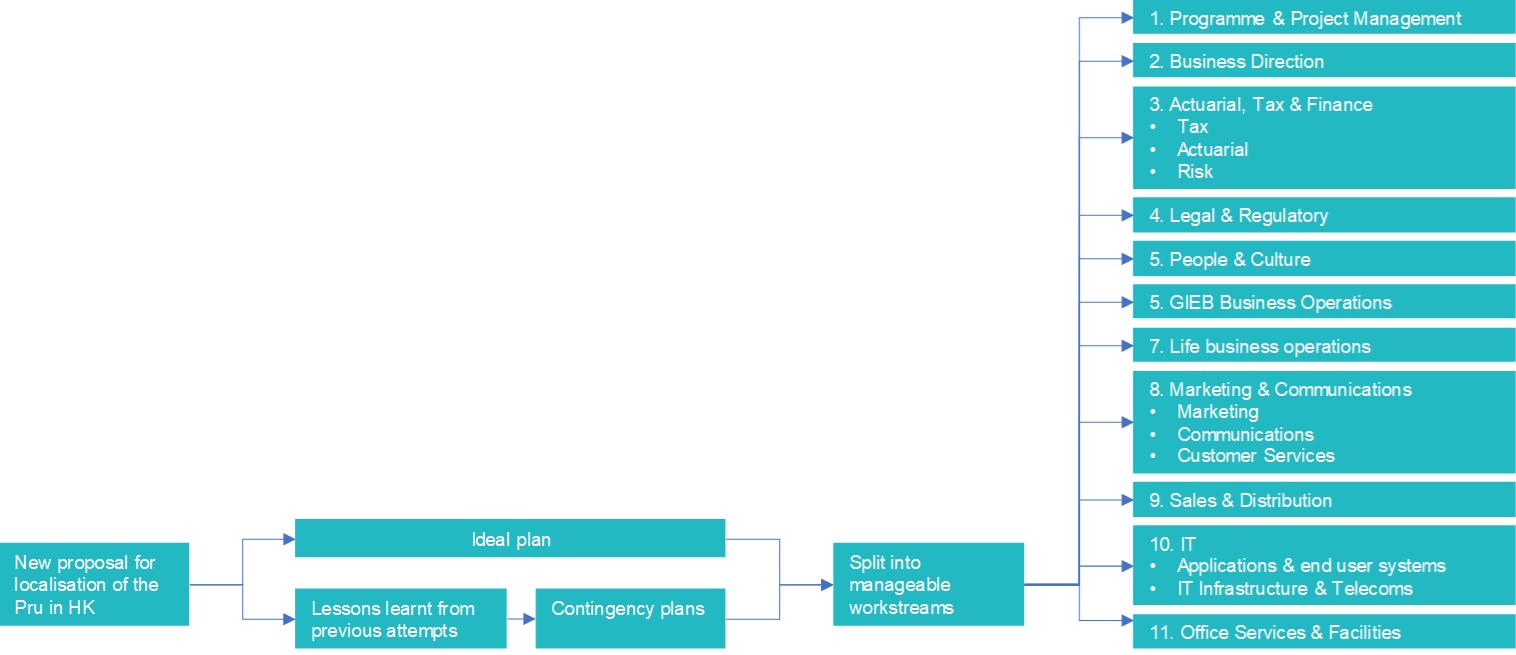

Prudential had endeavoured to transform Hong Kong from a UK branch to a standalone subsidiary. For its fifth attempt Prudential asked Innovation first to plan, then deliver the change.

The transaction revolved around allocating the correct asset valuation mix between UK and HK customers, then gaining regulatory approval in both jurisdictions. Four million HK customers also had also to be persuaded that the transaction was in their interest. In addition, data had to be separated and allocated into the two entities. Innovation managed all key operational workstreams to transition the branch into two new Hong Kong subsidiaries.

The starting point for Innovation’s team was to first study existing documentation on the previous attempts to deliver this proposal. Lessons were catalogued and used as the basis of a delivery plan that contained contingencies to cover previous pitfalls.

Our Programme Director led a team of seven Innovation Delivery Managers covering the actuarial, finance, asset transfer, operations, legal and IT workstreams. The domestication was successfully delivered to schedule on 31st December 2013.

During the programme the Innovation team overcame a number of key challenges including:

- Managing and negotiating with three regulators who had competing priorities

- Managing the relationship with OCI (Office for the Commissioner of Insurance, Hong Kong regulator) on behalf of the client

- Working to ensure the whole organisation understood the impact of people, process, systems and data change. The developing acceptance, finally implementing.