Implementing the IFRS 17/9/16 Target Operating Model

Target Operating Model (TOM) development is part of many IFRS 17/9/16 projects. However, time is short to undertake major TOM changes.

Target Operating Models (TOMs) describe what a ‘to-be’ operational process will look like. In the case of IFRS 17 (and IFRSs 9 and 16), there will be some changes to the operating model of an insurer, especially if its close process is somehow broken by the incoming standards. Keeping old practises could make an IFRS 17 close very hard. Plus the need to change gives an opportunity to improve the effectiveness of operational management.

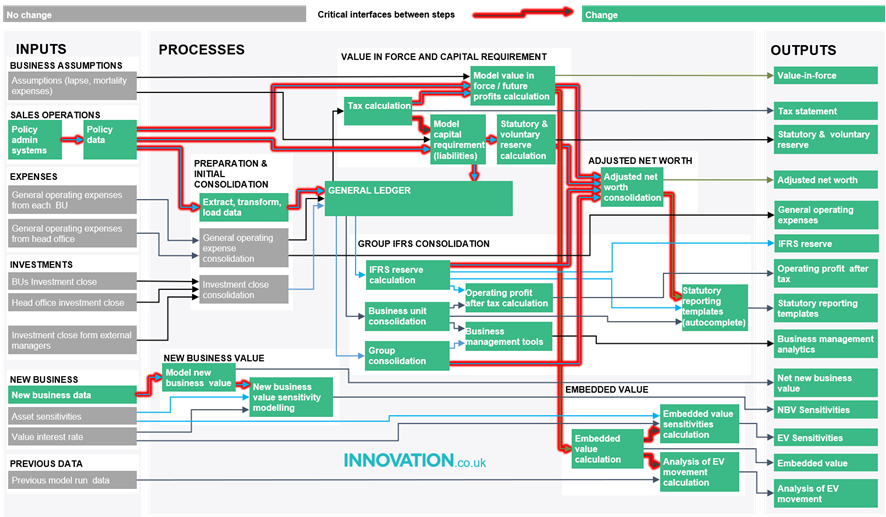

Many areas of the operating model will be affected by the incoming standards. These are illustrated above in our generic TOM for an insurance close. The boxes in green being the areas of the close that will be affected by the standard and are likely to need to change. The red lines show the greatest challenges to data-flow. Every time a step in the operating model changes, there will be impacts on its input requirements and the outputs to the next step. Operationally, major impacts will be seen:

- Policy administration systems (PASs) will have to supply additional data, some of which may be of a type not yet recorded.

- An accounting solution will have to be put in place. This will be especially challenging for companies who do not currently report in both EU and US.

- Valuation models will become more complex, with perhaps 30 to 60 times more effort to complete. Consequentially, prevailing models will become cumbersome – especially those who rely on model libraries.

- Audit of actuarial models will by external auditors will now happen because they will become part of the IFRS close. Models will somehow need to engineered to be measurable by external auditors. Manual interventions will be harder to justify.

- Ledgers and sub-ledgers will contain additional information, this will be compounded if an insurer chooses an accounting solution that relies on actuarial models for inputs.

- Increased disclosures by the accounting teams will put pressure on operational close activities.

- Volume of data will snowball. Old systems may crack under the pressure of requirements they weren’t designed to deliver. Manual transfer of information will become more difficult.